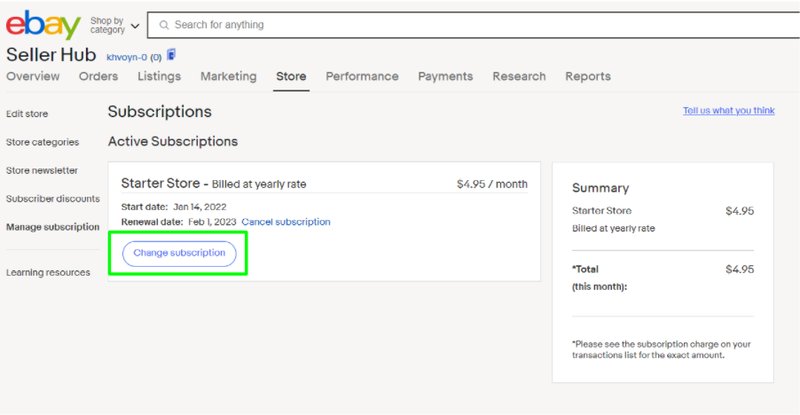

Eligible sellers may subscribe to an eBay Store at any time during the year. The subscription fee will appear on your monthly invoice.

The first month of your subscription is prorated based on your sign up date. For example, if you sign up on April 27th and you’re billed on the 1st of every month, you will be charged for the remaining 4 days in April (27, 28, 29, and 30) plus the month of May on May 1st.

Should you decide to cancel your subscription, you may do so at any time. You will have the full benefit of your subscription through the last day of the month you’ve cancelled in. For example, if you cancel your subscription on May 26th, you will have the full benefits of the subscription through May 31st, as you have already paid through to the end of the month. Your subscription will then be cancelled and you will not be billed on June 1st.